Well, the market has broken from this consolidation,

so we will have to see if the move holds. I have taken just a few positions, the best being PSEC which has been on for a while though I sold 1/3 for 5% and 1/3 for a quick 12% gain, and yesterday BAC was a good daytrade, and I held half overnight, but sold for breakeven today. I just bought some AKRX. I have also had the same amount or more of beak even and tight stop out trades, which is fine. I am inching forward. This is not a market to give anything much room or it can really run away from you. I will just keep slowly building positions as the market continues to creep up, but will move stops to breakeven as quickly as possible, and will be ready for a breakdown. This is just a time to keep warm, ride the bike, take some practice shots, and hope the game starts back up soon. No telling at this point.

Tuesday, August 30, 2011

Wednesday, August 10, 2011

Risky investors, conservative daytraders

I remember discussing the stock market with someone who thought I was a risky trader, what with being a daytrader at times, along with trading on longer timeframes. Well, it is this kind of action that makes me feel like the most conservative flavor of trader. I took on a long trade at the close yesterday (PSEC 8.01, pays a huge dividend monthly, +10% annually), and it flopped around my entry price today and closed down at the end of the day. That gave me the foul taste of what it is like to be holding positions in this market, and I bought near the current bottom. Can't imagine the anguish I would be feeling if I was well underwater in long term holds. The PSEC is a small position, and I will likely take more long positions if/when the market snaps back. One should only be nibbling down here, if holding at all.

Contrast the above unsavoriness with my daytrading:

Note that the NUAN play was not on my morning list. I have been using the Madscan scanner, and had it set on the "gapping higher and near highs" setting right at the open, and NUAN popped up. It was early in the day, and so, according to my trading plan, I traded 1/3 normal size and scalped it. Fortunately it ran like a scalded monkey and I got 4% in minutes. Hedge fund managers years can be made on 4%. Unfortunately for them they cannot churn millions through a stock like this without blowing it up, an important edge for the small lot trader.

This was a good daytrading day, as the market was fairly stable until the last hour. Even with the DOW down 300 points mid-day, it was really just chopping about, and this provided enough support for the high volume movers to work on their own with the rug being pulled out from under them (as happened in the last hour or so).

So I will give this damn PSEC more time to work, but I do feel I made a mistake not selling after it failed at 8.10; should have sold at 7.99, it had no business revisiting a 7 handle. This action re-affirms my distaste for bottom picking. If the market was up-trending this would not be an issue as time usually irons out poor entries, but watch this market drop another 10% before a violent snap back rally; but that is just guessing. We'll see.

Contrast the above unsavoriness with my daytrading:

Note that the NUAN play was not on my morning list. I have been using the Madscan scanner, and had it set on the "gapping higher and near highs" setting right at the open, and NUAN popped up. It was early in the day, and so, according to my trading plan, I traded 1/3 normal size and scalped it. Fortunately it ran like a scalded monkey and I got 4% in minutes. Hedge fund managers years can be made on 4%. Unfortunately for them they cannot churn millions through a stock like this without blowing it up, an important edge for the small lot trader.

This was a good daytrading day, as the market was fairly stable until the last hour. Even with the DOW down 300 points mid-day, it was really just chopping about, and this provided enough support for the high volume movers to work on their own with the rug being pulled out from under them (as happened in the last hour or so).

So I will give this damn PSEC more time to work, but I do feel I made a mistake not selling after it failed at 8.10; should have sold at 7.99, it had no business revisiting a 7 handle. This action re-affirms my distaste for bottom picking. If the market was up-trending this would not be an issue as time usually irons out poor entries, but watch this market drop another 10% before a violent snap back rally; but that is just guessing. We'll see.

Monday, August 8, 2011

Case of the Mondays

You know it is a bad market when a down day like today does not yet feel like capitulation. Since I label myself a trend trader, I had to capitulate myself and start trading to the short side, which I started on Friday. I only made 2 trades today and one on Friday. I made some money and that felt good enough, I did not want to push it. I did hunt for longs today and Friday, but the early list was so small, and the trading so weak after the first 20-30 mins, that I started poking around on the short side till I found something that fit my parameters. Today it was MCO (good gain) and NU (for a loss), Friday it was CLGX (good gain). It hardly matters, you could have randomly picked 10 stocks and have had all ten of them work out if you just blindly held them. Problem is I cannot foresee that, so I have to still play my game, with my same risk management parameters.

I have been reading and watching a bit more trading info than normal, seeing that this is an abnormal time, and have noticed a lot of active traders have been slow to move to the short side. Many had the same feeling I had, feeling a little foolish for not being short sooner, and I would say all these traders list themselves as trend traders. I think, truthfully, most of us fight a long bias. We believe that things will turn out for the best, that people will make and sell incredible new things, etc. Also, the previous trend has been 3 years up, so it takes a lot of evidence that the trend is down.

So the same for me still. All cash at night, make a trade or two during the day, bring home a 'paycheck' to my family. The market is so volatile that I am treading very carefully. This is not a time for me to be long stocks overnight. If the morning gappers are as thin tomorrow as they were today, (I think BSFT was the only long that looked any good. I didn't trade it; black candle) I will have some shorts up on my screen from the open.

Will we get capitulation, a big cathartic flush down? You might have thought Friday, but today was even larger volume. Will tomorrow be larger and lower? I don't know.

Will we get a violent snap back rally? No one knows. The leash is stretched pretty tight. Will gapper plays work during this? Maybe not. I may have to play the indexes, but there will have to be a setup there that I am comfortable with.

Lately we have been sliding down a wall of worry. It will be a good sign when the market starts shrugging off bad news. I have no idea when this will be. No one does.

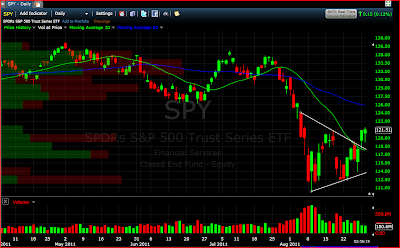

Will the SPY end up testing support around 100, or around 85, or the 2008 lows? No one knows.

One thing I do know. On the weekly chart, it does not look like the end of the world. Hopefully it will not get that way.

I have been reading and watching a bit more trading info than normal, seeing that this is an abnormal time, and have noticed a lot of active traders have been slow to move to the short side. Many had the same feeling I had, feeling a little foolish for not being short sooner, and I would say all these traders list themselves as trend traders. I think, truthfully, most of us fight a long bias. We believe that things will turn out for the best, that people will make and sell incredible new things, etc. Also, the previous trend has been 3 years up, so it takes a lot of evidence that the trend is down.

So the same for me still. All cash at night, make a trade or two during the day, bring home a 'paycheck' to my family. The market is so volatile that I am treading very carefully. This is not a time for me to be long stocks overnight. If the morning gappers are as thin tomorrow as they were today, (I think BSFT was the only long that looked any good. I didn't trade it; black candle) I will have some shorts up on my screen from the open.

Will we get capitulation, a big cathartic flush down? You might have thought Friday, but today was even larger volume. Will tomorrow be larger and lower? I don't know.

Will we get a violent snap back rally? No one knows. The leash is stretched pretty tight. Will gapper plays work during this? Maybe not. I may have to play the indexes, but there will have to be a setup there that I am comfortable with.

Lately we have been sliding down a wall of worry. It will be a good sign when the market starts shrugging off bad news. I have no idea when this will be. No one does.

Will the SPY end up testing support around 100, or around 85, or the 2008 lows? No one knows.

One thing I do know. On the weekly chart, it does not look like the end of the world. Hopefully it will not get that way.

Tuesday, August 2, 2011

I fought the shorts and the longs won.

I am very bearish the markets, the shorts are winning the battle right now, but all that matters to me are the little skirmishes I am involved in during the day. I have very little overnight exposure, and am focusing on day-trading only. I traded long today and did quite well playing earnings gaps. These stocks trade such high volume that they can move almost independently of the market, even on a down-trending day like today. Here is a screen shot of every trade I made today.

note: the CEF trade was just one trade broken up into lots. same with one or two others that were within a penny or two. all my day-trades are closed, no overnights.

I trade with some people whose winning trade percentages are well over 75%. That is not me. Notice I only had roughly a 50% win rate today, but my gains far out performed my losses. This is a very good snapshot of my current day-trading style, which I would say is: positioning my trades in the most volatile moments of the trading day and almost immediately getting out if I am wrong, and letting the trades work if they move up. The difference right now is that I am scalping more than I am letting the trades work, or just scaling out in larger fashion, and letting only a very small position continue trying. Its just that kind of market. When these stocks are fighting poor internals you just cannot give them any room. In RDN and MHP, for example, I only had 1/8 positions left to really work after scaling out on each advance. You can refer to my past posts with charts on how I do my entries and scale outs. My entries were simple breakout plays off the first minute bar, or a clear lower resistance level that lead to a intraday breakout.

My trades in the first 15 minutes are true scalps, the moment the stock turns down I am out. This is a rule in my trading plan. The H and CVLT losses were larger, price-wise, than the other trades, but these were very small positions that I projected to go very far and not scale out but just sell the whole lot at my price target. Neither worked for me (though CVLT did end up working, just not with me aboard).

The key to getting into these is the pre-market work: finding the stocks that are gapping up with volume; noting any resistance whether it be a price level or MA; knowing the difference between kickers, continuation gaps, area gaps, etc; making sure the volume once the stock is trading is indicating a big day, and prioritizing so you can be attacking the most likely trades off the first minute bars for initial scalps, and then taking more time later to analyze how others that have not yet moved yet are shaping up and determining entry levels and position sizes, and, most importantly, exits in case your trade goes the wrong way.

I have to thank John Lee for teaching me all this. I have said it before, and I will say it again, get a coach, all successful people have one, from the president to top athletes. It took me a long time to learn that being a lone wolf is not the way to go, a lesson I wish I had learned far sooner.

Lets hope this market can find some support and maybe work on getting to new yearly highs as I would like to be back into making swing trades, and even blogging on them as I realize I have not done much of that. If not, my swing trades may end up being to the short side. That has been the right play the last two weeks, but I am never as comfortable short as I am long, so it's day-trading for me right now.

note: the CEF trade was just one trade broken up into lots. same with one or two others that were within a penny or two. all my day-trades are closed, no overnights.

I trade with some people whose winning trade percentages are well over 75%. That is not me. Notice I only had roughly a 50% win rate today, but my gains far out performed my losses. This is a very good snapshot of my current day-trading style, which I would say is: positioning my trades in the most volatile moments of the trading day and almost immediately getting out if I am wrong, and letting the trades work if they move up. The difference right now is that I am scalping more than I am letting the trades work, or just scaling out in larger fashion, and letting only a very small position continue trying. Its just that kind of market. When these stocks are fighting poor internals you just cannot give them any room. In RDN and MHP, for example, I only had 1/8 positions left to really work after scaling out on each advance. You can refer to my past posts with charts on how I do my entries and scale outs. My entries were simple breakout plays off the first minute bar, or a clear lower resistance level that lead to a intraday breakout.

My trades in the first 15 minutes are true scalps, the moment the stock turns down I am out. This is a rule in my trading plan. The H and CVLT losses were larger, price-wise, than the other trades, but these were very small positions that I projected to go very far and not scale out but just sell the whole lot at my price target. Neither worked for me (though CVLT did end up working, just not with me aboard).

The key to getting into these is the pre-market work: finding the stocks that are gapping up with volume; noting any resistance whether it be a price level or MA; knowing the difference between kickers, continuation gaps, area gaps, etc; making sure the volume once the stock is trading is indicating a big day, and prioritizing so you can be attacking the most likely trades off the first minute bars for initial scalps, and then taking more time later to analyze how others that have not yet moved yet are shaping up and determining entry levels and position sizes, and, most importantly, exits in case your trade goes the wrong way.

I have to thank John Lee for teaching me all this. I have said it before, and I will say it again, get a coach, all successful people have one, from the president to top athletes. It took me a long time to learn that being a lone wolf is not the way to go, a lesson I wish I had learned far sooner.

Lets hope this market can find some support and maybe work on getting to new yearly highs as I would like to be back into making swing trades, and even blogging on them as I realize I have not done much of that. If not, my swing trades may end up being to the short side. That has been the right play the last two weeks, but I am never as comfortable short as I am long, so it's day-trading for me right now.

Subscribe to:

Posts (Atom)

Early winner/loser in 5g, Ericsson ERIC, Nokia NOK

I like to start collecting stock tickers for after the new year, stocks that have been beaten down and window dressed more than they deserve...

-

No really, here, but quiet on the blog front due to life happening. I have taken some swing (about to become long) positions, most notably ...

-

Good day. Being patient in the morning, being very careful with overnighting, and guarding profits was the key. Kunal at BOWS mentions about...

-

My trading has been flat and uninspiring the last week. I have chopped about, and for every good trade there has been a bad one. Today is a ...