Shame on me for not keeping a weather eye on my sectors lists, though an alert I set a while back did clue me in, but there is a nice bull market breakout going on right now in the XLU. Sure, utilities are your grandfathers stocks, but in this market, unless you are a savvy daytrader, trend following long setups have been in short supply. Check out the XLU:

Hey, maybe not the cleanest and most beautiful chart you have ever seen, but its something to go on for the long side. Check out DUK, one of the XLU components:

Compare the DUK chart with the XLU one. Notice how as XLU was setting up a nice flag under this resistance, DUK was leading the way. There are others like this in the sector, AEP and ED for example, and check out the day SD had. So utes are popping. Would have been smart to have noted the relative strength of the XLU, picked the ones near breakout, and maybe have got hold of a DUK or AEP. So the job now is to identify the best setups in this space, track the strength of the XLU during trading hours, and maybe you might get lucky. Might not be as poppy as biotechs, but following the bull always helps. Note that the XLU does have a history of false breakouts, at last resistance it popped and flopped, and I can even see another before that, so maybe this pop will need to fail once, rest, and then go. Time will tell.

Thursday, December 22, 2011

Tuesday, December 13, 2011

...and more patience

Market is just flopping around like a fish. I am keeping it light and infrequent waiting for some conviction either way. I am not trading it well, but from the comments from the twitterstream to the Economist, very few are trading this well, so I am just not trading (much). I will post more when something is happening...

Wednesday, November 23, 2011

Patience

I think the best and most seasoned traders have been on vacation for the past couple months or more. When you read Market Wizards, and they ask these successful traders why they don't manage other peoples money, I recall the answer being that they did try it but their clients could not handle being in cash for extended periods of time. The clients would see the small picture (Headline: Market up 300 points!) but miss the big picture that it has also been down 400 cumulative over the past week, and is in a medium or long term downtrend. I am sure there are some trading geniuses out there, but for the most part only the compulsive, passionate, or foolish traders are trading now. I am one of those 3, or maybe all 3. I am making some ground, but it is like trench warfare, pretty ugly. I am keeping it small and tight, taking profits quickly. I trade because I love it and learn every day. Here is a typical gain/loss page for me, this one from today, Wednesday:

I posted some time back that my biggest mistake was not turning to thedark short side early enough. Better late than never. Here is a good one I got today:

Most of my successful trades lately have come not from my early morning homework on gappers, but from monitoring my scanner and see what is getting consistent heavy volume. I got a good one in NG the middle of last week from that. My biggest mistakes have been finding the right balance of position sizing vs room for stops. It seems like you either need to have stops very very tight, or very very loose, anything else gets stopped out. I tend towards tight. Remember, your bottom line tells you whether you are doing it right or not, very simple.

I have been very patient with trades, half to a quarter as many on a average day, and also waiting longer for setups. I have not been taking much in the first few minutes unless it is a very clear setup, the stock is acting stable (no whacky candles and stop probes), and I just scalp, trailing stops up the minute bars and getting out on any horizontal price movement.

I recall my post on the first day of earnings season. I had hoped I would be attacking the gappers the whole season, but I have had to turn to other strategies as the gappers have been weighed down by the market, and just slower to develop during the day , so I have been following the volume more to try and squeeze out more certainty in my setups.

I posted some time back that my biggest mistake was not turning to the

Most of my successful trades lately have come not from my early morning homework on gappers, but from monitoring my scanner and see what is getting consistent heavy volume. I got a good one in NG the middle of last week from that. My biggest mistakes have been finding the right balance of position sizing vs room for stops. It seems like you either need to have stops very very tight, or very very loose, anything else gets stopped out. I tend towards tight. Remember, your bottom line tells you whether you are doing it right or not, very simple.

I have been very patient with trades, half to a quarter as many on a average day, and also waiting longer for setups. I have not been taking much in the first few minutes unless it is a very clear setup, the stock is acting stable (no whacky candles and stop probes), and I just scalp, trailing stops up the minute bars and getting out on any horizontal price movement.

I recall my post on the first day of earnings season. I had hoped I would be attacking the gappers the whole season, but I have had to turn to other strategies as the gappers have been weighed down by the market, and just slower to develop during the day , so I have been following the volume more to try and squeeze out more certainty in my setups.

Tuesday, November 1, 2011

Best and worst trades from November 1, 2011

My trading has been flat and uninspiring the last week. I have chopped about, and for every good trade there has been a bad one. Today is a perfect example. I caught a quick scalp in VRUS, only to go bottom fishing in MSFT (I know, I know, It is a POS but I am obsessed [warning] with this very long term setup on it and was going for an aggressive entry today).

Best trade:

Worst trade:

Best trade:

Worst trade:

Wednesday, October 12, 2011

Back in the saddle

Nice start to earnings season. Here are all the trades I placed today, which are all green and that is very rare for me:

(Notes: The AKS was a swing trade sell, you can see the buy dates on the trades. I bought some more OVTI today and when I sold it the program used my first buy as my entry. My daytrade was a +.20 and not the +.67 it is showing, my cost basis for what I am still holding is 16.21 as I mentioned in the last post. I will likely hard stop at b/e on this, taking too long for my taste even though it is slowly working).

The WHR trade was nice. I was already comfortable in ASML when Brad on the squwak called out WHR spiking on Buffet news. So I quickly took it at the break of highs after the initial spike at 57.47 and just trailed my stop up each minute bar, fast money.

Here is a marked up chart of my ASML trade:

(Notes: The AKS was a swing trade sell, you can see the buy dates on the trades. I bought some more OVTI today and when I sold it the program used my first buy as my entry. My daytrade was a +.20 and not the +.67 it is showing, my cost basis for what I am still holding is 16.21 as I mentioned in the last post. I will likely hard stop at b/e on this, taking too long for my taste even though it is slowly working).

The WHR trade was nice. I was already comfortable in ASML when Brad on the squwak called out WHR spiking on Buffet news. So I quickly took it at the break of highs after the initial spike at 57.47 and just trailed my stop up each minute bar, fast money.

Here is a marked up chart of my ASML trade:

Tuesday, October 11, 2011

Better action

Some babble off the top of my head about what is going on now: Game on! Market is trading a bit more predictably and solidly, so trading long for the short and intermediate term looking good. Now is the time to start building. Hard to say whether the market will just keep running away or will provide some pullbacks. Pullbacks should bounce, not lay around. The lows should not be breached. Technically the market is still in a range, but it has a different 'feel' to me, so I think we at least will break out of the top, giving some time to for strong stocks and high probability patterns to work on a swing time frame.

I did not call out these trades from the last week in real time as I have been sporadically trading, but I am in AKS, WFT, and OVTI. The OVTI I added at 16.21, so it is still buyable here, I may add to it tomorrow if the market is strong. I like the flag, but it needs to breakout in the next day or so. I will dump it below 16.

I am back in the seat full time now for earnings season.

I did not call out these trades from the last week in real time as I have been sporadically trading, but I am in AKS, WFT, and OVTI. The OVTI I added at 16.21, so it is still buyable here, I may add to it tomorrow if the market is strong. I like the flag, but it needs to breakout in the next day or so. I will dump it below 16.

I am back in the seat full time now for earnings season.

Saturday, October 1, 2011

Nothing doing

It was a good time to go on vacation. I put on some swings, checked in once or twice a day, made a few, lost a few, just staying warm. Nothing has changed so there is no real edge here, the tide is slack, the game is on time out. I will keep taking a few shots to stay warm, and if they start working I will slowly start to add.

Really, nothing has changed in weeks now. I am sure there are some people killing it in here, I will continue to study and see if I can find what works in this sort of environment, as what is 'now' tends to stay 'now' for longer than people prefer. This lost decade could turn into two, so we could have lots of this sort of action in the future. Follow the cheese.

For now, patience. If nothing else then have to wait for earnings season and see if the independent intraday movers and gappers can trade well.

Really, nothing has changed in weeks now. I am sure there are some people killing it in here, I will continue to study and see if I can find what works in this sort of environment, as what is 'now' tends to stay 'now' for longer than people prefer. This lost decade could turn into two, so we could have lots of this sort of action in the future. Follow the cheese.

For now, patience. If nothing else then have to wait for earnings season and see if the independent intraday movers and gappers can trade well.

Tuesday, August 30, 2011

Slow times

Well, the market has broken from this consolidation,

so we will have to see if the move holds. I have taken just a few positions, the best being PSEC which has been on for a while though I sold 1/3 for 5% and 1/3 for a quick 12% gain, and yesterday BAC was a good daytrade, and I held half overnight, but sold for breakeven today. I just bought some AKRX. I have also had the same amount or more of beak even and tight stop out trades, which is fine. I am inching forward. This is not a market to give anything much room or it can really run away from you. I will just keep slowly building positions as the market continues to creep up, but will move stops to breakeven as quickly as possible, and will be ready for a breakdown. This is just a time to keep warm, ride the bike, take some practice shots, and hope the game starts back up soon. No telling at this point.

so we will have to see if the move holds. I have taken just a few positions, the best being PSEC which has been on for a while though I sold 1/3 for 5% and 1/3 for a quick 12% gain, and yesterday BAC was a good daytrade, and I held half overnight, but sold for breakeven today. I just bought some AKRX. I have also had the same amount or more of beak even and tight stop out trades, which is fine. I am inching forward. This is not a market to give anything much room or it can really run away from you. I will just keep slowly building positions as the market continues to creep up, but will move stops to breakeven as quickly as possible, and will be ready for a breakdown. This is just a time to keep warm, ride the bike, take some practice shots, and hope the game starts back up soon. No telling at this point.

Wednesday, August 10, 2011

Risky investors, conservative daytraders

I remember discussing the stock market with someone who thought I was a risky trader, what with being a daytrader at times, along with trading on longer timeframes. Well, it is this kind of action that makes me feel like the most conservative flavor of trader. I took on a long trade at the close yesterday (PSEC 8.01, pays a huge dividend monthly, +10% annually), and it flopped around my entry price today and closed down at the end of the day. That gave me the foul taste of what it is like to be holding positions in this market, and I bought near the current bottom. Can't imagine the anguish I would be feeling if I was well underwater in long term holds. The PSEC is a small position, and I will likely take more long positions if/when the market snaps back. One should only be nibbling down here, if holding at all.

Contrast the above unsavoriness with my daytrading:

Note that the NUAN play was not on my morning list. I have been using the Madscan scanner, and had it set on the "gapping higher and near highs" setting right at the open, and NUAN popped up. It was early in the day, and so, according to my trading plan, I traded 1/3 normal size and scalped it. Fortunately it ran like a scalded monkey and I got 4% in minutes. Hedge fund managers years can be made on 4%. Unfortunately for them they cannot churn millions through a stock like this without blowing it up, an important edge for the small lot trader.

This was a good daytrading day, as the market was fairly stable until the last hour. Even with the DOW down 300 points mid-day, it was really just chopping about, and this provided enough support for the high volume movers to work on their own with the rug being pulled out from under them (as happened in the last hour or so).

So I will give this damn PSEC more time to work, but I do feel I made a mistake not selling after it failed at 8.10; should have sold at 7.99, it had no business revisiting a 7 handle. This action re-affirms my distaste for bottom picking. If the market was up-trending this would not be an issue as time usually irons out poor entries, but watch this market drop another 10% before a violent snap back rally; but that is just guessing. We'll see.

Contrast the above unsavoriness with my daytrading:

Note that the NUAN play was not on my morning list. I have been using the Madscan scanner, and had it set on the "gapping higher and near highs" setting right at the open, and NUAN popped up. It was early in the day, and so, according to my trading plan, I traded 1/3 normal size and scalped it. Fortunately it ran like a scalded monkey and I got 4% in minutes. Hedge fund managers years can be made on 4%. Unfortunately for them they cannot churn millions through a stock like this without blowing it up, an important edge for the small lot trader.

This was a good daytrading day, as the market was fairly stable until the last hour. Even with the DOW down 300 points mid-day, it was really just chopping about, and this provided enough support for the high volume movers to work on their own with the rug being pulled out from under them (as happened in the last hour or so).

So I will give this damn PSEC more time to work, but I do feel I made a mistake not selling after it failed at 8.10; should have sold at 7.99, it had no business revisiting a 7 handle. This action re-affirms my distaste for bottom picking. If the market was up-trending this would not be an issue as time usually irons out poor entries, but watch this market drop another 10% before a violent snap back rally; but that is just guessing. We'll see.

Monday, August 8, 2011

Case of the Mondays

You know it is a bad market when a down day like today does not yet feel like capitulation. Since I label myself a trend trader, I had to capitulate myself and start trading to the short side, which I started on Friday. I only made 2 trades today and one on Friday. I made some money and that felt good enough, I did not want to push it. I did hunt for longs today and Friday, but the early list was so small, and the trading so weak after the first 20-30 mins, that I started poking around on the short side till I found something that fit my parameters. Today it was MCO (good gain) and NU (for a loss), Friday it was CLGX (good gain). It hardly matters, you could have randomly picked 10 stocks and have had all ten of them work out if you just blindly held them. Problem is I cannot foresee that, so I have to still play my game, with my same risk management parameters.

I have been reading and watching a bit more trading info than normal, seeing that this is an abnormal time, and have noticed a lot of active traders have been slow to move to the short side. Many had the same feeling I had, feeling a little foolish for not being short sooner, and I would say all these traders list themselves as trend traders. I think, truthfully, most of us fight a long bias. We believe that things will turn out for the best, that people will make and sell incredible new things, etc. Also, the previous trend has been 3 years up, so it takes a lot of evidence that the trend is down.

So the same for me still. All cash at night, make a trade or two during the day, bring home a 'paycheck' to my family. The market is so volatile that I am treading very carefully. This is not a time for me to be long stocks overnight. If the morning gappers are as thin tomorrow as they were today, (I think BSFT was the only long that looked any good. I didn't trade it; black candle) I will have some shorts up on my screen from the open.

Will we get capitulation, a big cathartic flush down? You might have thought Friday, but today was even larger volume. Will tomorrow be larger and lower? I don't know.

Will we get a violent snap back rally? No one knows. The leash is stretched pretty tight. Will gapper plays work during this? Maybe not. I may have to play the indexes, but there will have to be a setup there that I am comfortable with.

Lately we have been sliding down a wall of worry. It will be a good sign when the market starts shrugging off bad news. I have no idea when this will be. No one does.

Will the SPY end up testing support around 100, or around 85, or the 2008 lows? No one knows.

One thing I do know. On the weekly chart, it does not look like the end of the world. Hopefully it will not get that way.

I have been reading and watching a bit more trading info than normal, seeing that this is an abnormal time, and have noticed a lot of active traders have been slow to move to the short side. Many had the same feeling I had, feeling a little foolish for not being short sooner, and I would say all these traders list themselves as trend traders. I think, truthfully, most of us fight a long bias. We believe that things will turn out for the best, that people will make and sell incredible new things, etc. Also, the previous trend has been 3 years up, so it takes a lot of evidence that the trend is down.

So the same for me still. All cash at night, make a trade or two during the day, bring home a 'paycheck' to my family. The market is so volatile that I am treading very carefully. This is not a time for me to be long stocks overnight. If the morning gappers are as thin tomorrow as they were today, (I think BSFT was the only long that looked any good. I didn't trade it; black candle) I will have some shorts up on my screen from the open.

Will we get capitulation, a big cathartic flush down? You might have thought Friday, but today was even larger volume. Will tomorrow be larger and lower? I don't know.

Will we get a violent snap back rally? No one knows. The leash is stretched pretty tight. Will gapper plays work during this? Maybe not. I may have to play the indexes, but there will have to be a setup there that I am comfortable with.

Lately we have been sliding down a wall of worry. It will be a good sign when the market starts shrugging off bad news. I have no idea when this will be. No one does.

Will the SPY end up testing support around 100, or around 85, or the 2008 lows? No one knows.

One thing I do know. On the weekly chart, it does not look like the end of the world. Hopefully it will not get that way.

Tuesday, August 2, 2011

I fought the shorts and the longs won.

I am very bearish the markets, the shorts are winning the battle right now, but all that matters to me are the little skirmishes I am involved in during the day. I have very little overnight exposure, and am focusing on day-trading only. I traded long today and did quite well playing earnings gaps. These stocks trade such high volume that they can move almost independently of the market, even on a down-trending day like today. Here is a screen shot of every trade I made today.

note: the CEF trade was just one trade broken up into lots. same with one or two others that were within a penny or two. all my day-trades are closed, no overnights.

I trade with some people whose winning trade percentages are well over 75%. That is not me. Notice I only had roughly a 50% win rate today, but my gains far out performed my losses. This is a very good snapshot of my current day-trading style, which I would say is: positioning my trades in the most volatile moments of the trading day and almost immediately getting out if I am wrong, and letting the trades work if they move up. The difference right now is that I am scalping more than I am letting the trades work, or just scaling out in larger fashion, and letting only a very small position continue trying. Its just that kind of market. When these stocks are fighting poor internals you just cannot give them any room. In RDN and MHP, for example, I only had 1/8 positions left to really work after scaling out on each advance. You can refer to my past posts with charts on how I do my entries and scale outs. My entries were simple breakout plays off the first minute bar, or a clear lower resistance level that lead to a intraday breakout.

My trades in the first 15 minutes are true scalps, the moment the stock turns down I am out. This is a rule in my trading plan. The H and CVLT losses were larger, price-wise, than the other trades, but these were very small positions that I projected to go very far and not scale out but just sell the whole lot at my price target. Neither worked for me (though CVLT did end up working, just not with me aboard).

The key to getting into these is the pre-market work: finding the stocks that are gapping up with volume; noting any resistance whether it be a price level or MA; knowing the difference between kickers, continuation gaps, area gaps, etc; making sure the volume once the stock is trading is indicating a big day, and prioritizing so you can be attacking the most likely trades off the first minute bars for initial scalps, and then taking more time later to analyze how others that have not yet moved yet are shaping up and determining entry levels and position sizes, and, most importantly, exits in case your trade goes the wrong way.

I have to thank John Lee for teaching me all this. I have said it before, and I will say it again, get a coach, all successful people have one, from the president to top athletes. It took me a long time to learn that being a lone wolf is not the way to go, a lesson I wish I had learned far sooner.

Lets hope this market can find some support and maybe work on getting to new yearly highs as I would like to be back into making swing trades, and even blogging on them as I realize I have not done much of that. If not, my swing trades may end up being to the short side. That has been the right play the last two weeks, but I am never as comfortable short as I am long, so it's day-trading for me right now.

note: the CEF trade was just one trade broken up into lots. same with one or two others that were within a penny or two. all my day-trades are closed, no overnights.

I trade with some people whose winning trade percentages are well over 75%. That is not me. Notice I only had roughly a 50% win rate today, but my gains far out performed my losses. This is a very good snapshot of my current day-trading style, which I would say is: positioning my trades in the most volatile moments of the trading day and almost immediately getting out if I am wrong, and letting the trades work if they move up. The difference right now is that I am scalping more than I am letting the trades work, or just scaling out in larger fashion, and letting only a very small position continue trying. Its just that kind of market. When these stocks are fighting poor internals you just cannot give them any room. In RDN and MHP, for example, I only had 1/8 positions left to really work after scaling out on each advance. You can refer to my past posts with charts on how I do my entries and scale outs. My entries were simple breakout plays off the first minute bar, or a clear lower resistance level that lead to a intraday breakout.

My trades in the first 15 minutes are true scalps, the moment the stock turns down I am out. This is a rule in my trading plan. The H and CVLT losses were larger, price-wise, than the other trades, but these were very small positions that I projected to go very far and not scale out but just sell the whole lot at my price target. Neither worked for me (though CVLT did end up working, just not with me aboard).

The key to getting into these is the pre-market work: finding the stocks that are gapping up with volume; noting any resistance whether it be a price level or MA; knowing the difference between kickers, continuation gaps, area gaps, etc; making sure the volume once the stock is trading is indicating a big day, and prioritizing so you can be attacking the most likely trades off the first minute bars for initial scalps, and then taking more time later to analyze how others that have not yet moved yet are shaping up and determining entry levels and position sizes, and, most importantly, exits in case your trade goes the wrong way.

I have to thank John Lee for teaching me all this. I have said it before, and I will say it again, get a coach, all successful people have one, from the president to top athletes. It took me a long time to learn that being a lone wolf is not the way to go, a lesson I wish I had learned far sooner.

Lets hope this market can find some support and maybe work on getting to new yearly highs as I would like to be back into making swing trades, and even blogging on them as I realize I have not done much of that. If not, my swing trades may end up being to the short side. That has been the right play the last two weeks, but I am never as comfortable short as I am long, so it's day-trading for me right now.

Tuesday, July 26, 2011

Best and worst trades from Tuesday, July 26th, 2011

Market continues to chop around. Been trading 'bread and butter' earnings gap plays as they mostly trade on their own mojo unless the market is really in a lather, and I don't have to hold overnight (though I do have some swings, but less and less over the last week). They are trading a bit less explosively than I have experienced (but its early in the season yet), so I am taking smaller positions and letting them work, rather that taking larger positions and scaling out. My trading has been very protective. Good trades in ACIW, SANM, and WAB, not so good in SVU and PLXT.

The bad:

So the rest of the day I went smaller and let things work. Though ACIW was my best trade (took it from the 1st minute bar, was in my top watch list even before earnings), WAB is good because I don't trade the downtrend break on earnings gap pullbacks as much as I should. I was just going through all the earnings plays and I took the simple WAB trade off a slightly bent downtrend break, but it offered such a nice flag and so much upside potential (it could have retraced the whole days pattern and broken out) that it was an easy take, and it made a dollar move in 15 minutes. No home run, but I'll take a point any time.

The bad:

So the rest of the day I went smaller and let things work. Though ACIW was my best trade (took it from the 1st minute bar, was in my top watch list even before earnings), WAB is good because I don't trade the downtrend break on earnings gap pullbacks as much as I should. I was just going through all the earnings plays and I took the simple WAB trade off a slightly bent downtrend break, but it offered such a nice flag and so much upside potential (it could have retraced the whole days pattern and broken out) that it was an easy take, and it made a dollar move in 15 minutes. No home run, but I'll take a point any time.

Tuesday, July 12, 2011

Where to be...

Will the market consolidate, find its footing, and move up to news highs? I have no idea, but if it starts to move I will be focusing on industries that have shown strength in the last run, some of which I have already established positions.

The ITA has been strong, and has now pulled back from bouncing off the top of its channel. This moves in legs, so look for the turn and then focus on good setups in the space.

IYR. Real estate confounding macro traders, similar to the retail space.

IBB. The dreaded biotechs, sure to eat a hole in your gut on overnight holds. Risk/reward higher here, and it may be valid to feel that the risk outweighs the reward. Some component stocks have really been moving (IMGN, RIGL, ADLR sold off today, keep em tight, GERN for example) , so lets see if the IBB can break and hold.

EWM and IDX. This region is hot, but there is some unrest right now in Malaysia... but if there is not unrest, it is just around the corner, so really, you just have to trade it how you see it. I like the IDX, has more pop than EWM, and is holding well here.

The ITA has been strong, and has now pulled back from bouncing off the top of its channel. This moves in legs, so look for the turn and then focus on good setups in the space.

IYR. Real estate confounding macro traders, similar to the retail space.

IBB. The dreaded biotechs, sure to eat a hole in your gut on overnight holds. Risk/reward higher here, and it may be valid to feel that the risk outweighs the reward. Some component stocks have really been moving (IMGN, RIGL, ADLR sold off today, keep em tight, GERN for example) , so lets see if the IBB can break and hold.

EWM and IDX. This region is hot, but there is some unrest right now in Malaysia... but if there is not unrest, it is just around the corner, so really, you just have to trade it how you see it. I like the IDX, has more pop than EWM, and is holding well here.

Monday, June 20, 2011

2 strong charts

Terrible market, best be in cash, but for the active long traders, here are a couple worth watching.

Both these tickers are at major resistance, so they will need to break through with volume, respect the breakout levels once they break through, and be prompt about it as, again, going long in this choppy market is not advisable. If the general market does turn up with conviction, and their industry or region is strong, these could be leaders:

NOC. Watch the ITA (aerospace index) chart which is in a nice looking consolidation. If the ITA breaks out, NOC should be responding, if not leading. This is a defense stock, so it will not apply to a SRI or 'green' portfolio:

EWM: This region has been strong, I am also watching IDX closely. You have to be able to tolerate gaps and news driven events that are disconnected from the US, so plan accordingly. If you plot the EWM over the SPX, you will notice that EWM is sympathetic, so make sure the market is working or at least neutral and EWM may continue to outperform. You can also watch the movement of the EEM for support, like you would do the ITA for NOC, iykwim ;) I've taken a preemptive position in this one (higher risk than waiting for price and volume confirmation) but keeping it smaller, probably look to sell if it dips back under 14.75, can always get back in on the break.

Both these tickers are at major resistance, so they will need to break through with volume, respect the breakout levels once they break through, and be prompt about it as, again, going long in this choppy market is not advisable. If the general market does turn up with conviction, and their industry or region is strong, these could be leaders:

NOC. Watch the ITA (aerospace index) chart which is in a nice looking consolidation. If the ITA breaks out, NOC should be responding, if not leading. This is a defense stock, so it will not apply to a SRI or 'green' portfolio:

EWM: This region has been strong, I am also watching IDX closely. You have to be able to tolerate gaps and news driven events that are disconnected from the US, so plan accordingly. If you plot the EWM over the SPX, you will notice that EWM is sympathetic, so make sure the market is working or at least neutral and EWM may continue to outperform. You can also watch the movement of the EEM for support, like you would do the ITA for NOC, iykwim ;) I've taken a preemptive position in this one (higher risk than waiting for price and volume confirmation) but keeping it smaller, probably look to sell if it dips back under 14.75, can always get back in on the break.

Wednesday, June 15, 2011

mid-season report on predictions for 2011

I don't trade based on guesses on what will happen months ahead but I had to throw my hat in the ring for the fun of it. Here are my predictions and comments in (parentheses) on how I am fairing so far:

Gold/Precious metals: Still upside (nice and vague for the win!... so far)

Food and Water: Biggest upside into 2012 and beyond, outperforms all commodities. Invest in water, hoard physical. (Ah... no. but the charts appear to be basing for another run. I still think this has much potential)

Market as a whole: May have a significant pullback, but ends up for year. My guess is N shaped, up, down, up. Second guess is V shape, down soon, then up. Cycle theory says this is most probable, but I am going with N. (well, the N shape is shaping, though more like a tilda since N is really impossible)

Semi's may lurch back, but gain for the year (shoulda said M shape for first half)

UNG and TBT: Still too early. Maybe TBT in last quarter. Oil up, but not enough to help UNG and solar. (correct so far)

Solar: still, and always, sucks (and I am a fan), ...until 2nd half, then start moving (Correct, and I have no idea why I thought solar will move in the second half of the year, or at all this decade, but we'll see)

Homies: still suck, all year (correct)

Telecom: Outperforms in a boring way (yes, up so far)

Retail: Outperforms in a no one can believe it way (eyeball glance says 6% gain so far, not bad)

Energy: Good first half, bad second. (good first quarter, bad second, see how this one plays out)

Finnies: Gets everyone lathered, then breaks hearts. (so far, yes)

Super Bowl: Ravens or Falcons... Falcons it is. (did you pick the Packers?)

British Open: Els

Wimpleton: Murray, feel good story.

Tour: Schleck

Bolt goes 9.54 (struggling 9.91 in Rome making this seem unlikely. Get back on the juice Bolt!)

ASP: Fanning

Coin flip: Tails

Gold/Precious metals: Still upside (nice and vague for the win!... so far)

Food and Water: Biggest upside into 2012 and beyond, outperforms all commodities. Invest in water, hoard physical. (Ah... no. but the charts appear to be basing for another run. I still think this has much potential)

Market as a whole: May have a significant pullback, but ends up for year. My guess is N shaped, up, down, up. Second guess is V shape, down soon, then up. Cycle theory says this is most probable, but I am going with N. (well, the N shape is shaping, though more like a tilda since N is really impossible)

Semi's may lurch back, but gain for the year (shoulda said M shape for first half)

UNG and TBT: Still too early. Maybe TBT in last quarter. Oil up, but not enough to help UNG and solar. (correct so far)

Solar: still, and always, sucks (and I am a fan), ...until 2nd half, then start moving (Correct, and I have no idea why I thought solar will move in the second half of the year, or at all this decade, but we'll see)

Homies: still suck, all year (correct)

Telecom: Outperforms in a boring way (yes, up so far)

Retail: Outperforms in a no one can believe it way (eyeball glance says 6% gain so far, not bad)

Energy: Good first half, bad second. (good first quarter, bad second, see how this one plays out)

Finnies: Gets everyone lathered, then breaks hearts. (so far, yes)

Super Bowl: Ravens or Falcons... Falcons it is. (did you pick the Packers?)

British Open: Els

Wimpleton: Murray, feel good story.

Tour: Schleck

Bolt goes 9.54 (struggling 9.91 in Rome making this seem unlikely. Get back on the juice Bolt!)

ASP: Fanning

Coin flip: Tails

Wednesday, June 1, 2011

What choppy market?

Well, the SPY broke the channel to the upside, technically looking very bullish, and then gave it all back and then some. So it seems we are back to the chop that has defined the market since late February. Regardless of this broad characterization of the market there have been places to put your money that have been in bullish trends.

One quick example is the XLP. When things get shaky, consumer staples, that is pretty basic stuff. Indeed the XLP was futzing about for a bit, but once it started breaking out (again) for good, one had plenty of time to notice and start looking at some consumer staple stocks.

NUS had sent off a signal flare with a gap up and huge volume day, pulled back to digest in orderly fashion, and then took off for a 25%+ gain in short order. The big gains and volume came in while the index was well into the breakout, so even if you did not get in on the gap or pullback, you could have bought at a couple breakout levels and still have caught most the move.

So the lesson is to monitor the industries, look for the uptrends, and then do some stock picking. There is always a bull market somewhere.

One quick example is the XLP. When things get shaky, consumer staples, that is pretty basic stuff. Indeed the XLP was futzing about for a bit, but once it started breaking out (again) for good, one had plenty of time to notice and start looking at some consumer staple stocks.

NUS had sent off a signal flare with a gap up and huge volume day, pulled back to digest in orderly fashion, and then took off for a 25%+ gain in short order. The big gains and volume came in while the index was well into the breakout, so even if you did not get in on the gap or pullback, you could have bought at a couple breakout levels and still have caught most the move.

So the lesson is to monitor the industries, look for the uptrends, and then do some stock picking. There is always a bull market somewhere.

Friday, May 13, 2011

CREE swing trade

This is a bit late but Blogger posting was down for over 24hrs.

Someone in our trading room (Leonard!) mentioned the daily chart on CREE a few days back. I took care to take notice as this person has demonstrated good ability to buy on pullback and support, something that I have been trying to improve. When I took a look I liked what I saw. If you click on the chart below you can see how tight the price action was getting, and on the 10th CREE put in a bullish gravestone doji; good risk/reward entry point.

So the next day I had CREE up on my screen first thing, and took it on the break of the high. You can see the entry by clicking on the chart below. I scaled out of ⅔’s of the position by days end, and sold the last ⅓ today for a 9% ($39.38 to $43.24) gain in 2 days. I do think CREE potentially has a lot more upside, it may have put in a bottom here, or it could plunge to new lows, only time will tell.

Someone in our trading room (Leonard!) mentioned the daily chart on CREE a few days back. I took care to take notice as this person has demonstrated good ability to buy on pullback and support, something that I have been trying to improve. When I took a look I liked what I saw. If you click on the chart below you can see how tight the price action was getting, and on the 10th CREE put in a bullish gravestone doji; good risk/reward entry point.

So the next day I had CREE up on my screen first thing, and took it on the break of the high. You can see the entry by clicking on the chart below. I scaled out of ⅔’s of the position by days end, and sold the last ⅓ today for a 9% ($39.38 to $43.24) gain in 2 days. I do think CREE potentially has a lot more upside, it may have put in a bottom here, or it could plunge to new lows, only time will tell.

Tuesday, May 3, 2011

Silver away

The gloat: Sold my core position and the rest of my swings in SLV today. I bought a full position in it for $18.50 back in August, sold chunks along the way, and held on to 1/4 of the position as my core holding. I sold it today at $41.94, a return of 126% on that portion!

The important part: This was a very hard decision, but I was suddenly watching SLV too much, and I realized that if it gave up more in price, that the mental harm of that would be greater to my trading psyche than selling and watching it go to new highs (which may well happen). It was just hurting too much watching it retrace, I was losing my cool, and that is a bad sign.

I am still a newer trader, and I am building my capital, so better to be conservative, take my gains, and build from there, not suffer a big draw down in hopes that it goes parabolic again. I wish I had bought more, but again, the size I took was inline with my risk tolerance, and as as my capital grows, I will be able to take larger positions.

The chart says its done even if my gut, and my hopes, say it has more to go. If it does, I will trade it again. I made a great trade, time to move on, and if I trade it again, I can start fresh. I had converted some of my SLV swing (entry about 2 months ago) to DGP, and will hold that for now in case PM's decide to put another leg in. SLV sure looks done on the daily, but there is a lot of emotion here in metals, so I anticipate making more trades, but they will likely be swing trades at the longest, and more likely scalps and daytrades. There is still much opportunity here, I will be watching and trading. Heck, if it keeps backing off even more today I must just have to buy back in ;)

The important part: This was a very hard decision, but I was suddenly watching SLV too much, and I realized that if it gave up more in price, that the mental harm of that would be greater to my trading psyche than selling and watching it go to new highs (which may well happen). It was just hurting too much watching it retrace, I was losing my cool, and that is a bad sign.

I am still a newer trader, and I am building my capital, so better to be conservative, take my gains, and build from there, not suffer a big draw down in hopes that it goes parabolic again. I wish I had bought more, but again, the size I took was inline with my risk tolerance, and as as my capital grows, I will be able to take larger positions.

The chart says its done even if my gut, and my hopes, say it has more to go. If it does, I will trade it again. I made a great trade, time to move on, and if I trade it again, I can start fresh. I had converted some of my SLV swing (entry about 2 months ago) to DGP, and will hold that for now in case PM's decide to put another leg in. SLV sure looks done on the daily, but there is a lot of emotion here in metals, so I anticipate making more trades, but they will likely be swing trades at the longest, and more likely scalps and daytrades. There is still much opportunity here, I will be watching and trading. Heck, if it keeps backing off even more today I must just have to buy back in ;)

Sunday, April 24, 2011

follow up to "where is the market going"

First off, beware what you read on blogs. Case in point, I mentioned in my previous post that Canada did not have much debt as a country. Not true, I decided to check on that, and Canada has debt that accounts for over 50% GDP, one of the highest debt ratios in the world, and I see that its citizens are over extending themselves in real estate, with many articles talking of a Canadian RE bubble and collapse. Amusing. I just talked with someone who is involved in pink sheet Canadian REIT's, but he is obviously a high risk taker. Boy, bubble signs and worth looking into, might be a parabolic rally brewing there to catch, but I have not looked into it yet. I still hold firm on my disdain for Celine Dion.

The head and shoulders is still in play on the SPY, and the dollar continues to fail, so this is very bullish for the markets. Game still on, but really, we are still in a range, and choppy trading should be expected. I still am sticking with my earnings gap plays (daytrading, bread and butter low risk trades) and silver/gold swings.

On Thursday silver traded WITH the dollar throughout the trading day and UP off of flat gold, first time I have seen that. So silver is starting to show some signs of a parabolic move. How long it will last I have no idea, but as long as the dollar plunges, and as long as silver outperforms gold and the miners, it is the place to be. This is great validation for me on my trading strategy, as price action dictated SLV (or AGQ) as the place to be, and that is where I placed the majority of my metals trade. I am still looking for rotation to gold or the miners, so we will see. The lesson over and over and over again is: ONLY PRICE PAYS, watch the price action. Not what you think, not what the blogosphere is ranting about, not what Cramer is calmly telling you, not what your broker/co-worker/neighbor says who is convinced its all about solar. Price, price, price.

The head and shoulders is still in play on the SPY, and the dollar continues to fail, so this is very bullish for the markets. Game still on, but really, we are still in a range, and choppy trading should be expected. I still am sticking with my earnings gap plays (daytrading, bread and butter low risk trades) and silver/gold swings.

On Thursday silver traded WITH the dollar throughout the trading day and UP off of flat gold, first time I have seen that. So silver is starting to show some signs of a parabolic move. How long it will last I have no idea, but as long as the dollar plunges, and as long as silver outperforms gold and the miners, it is the place to be. This is great validation for me on my trading strategy, as price action dictated SLV (or AGQ) as the place to be, and that is where I placed the majority of my metals trade. I am still looking for rotation to gold or the miners, so we will see. The lesson over and over and over again is: ONLY PRICE PAYS, watch the price action. Not what you think, not what the blogosphere is ranting about, not what Cramer is calmly telling you, not what your broker/co-worker/neighbor says who is convinced its all about solar. Price, price, price.

Saturday, April 16, 2011

Where is the market going

Short answer: We are still stuck in a range, and until we break up and out we are still in the chop zone, but...

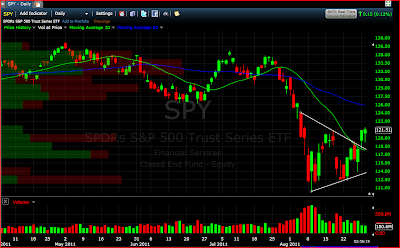

Long version: ... we are at a bit of a decision point. Let's start with the S&P chart (SPY)

2 things, the obvious inverse head and shoulders pattern and the moving averages. I don't actively seek out h&s's, and the market could flick this pattern off like dandruff, but everybody must be talking about it (not been following twitter or doing much blog reading as of late). It makes for a bullish scenario. Also, the market managed to get above the 2 MA's, the 20 and 50, so this should act as support. We lose these averages on Monday and I am immediately cautious.

Since I am now spinning silver dubs on my Datsun B210, I take great interest in what the dollar is up to, as monetary policy drives the markets. I use the UUP for a quick read (check the vol on UDN friday, probably nothing, but), and then the EURO as my main benchmark. Why the Euro? In my mind it is the most 'like' comparison. Pound, country too small; Yen, govs are fighting to break it (trade on); Canadia, too solvent and Celine Dion; etc. Right now the charts are coiled up, with a move coming. More weakness will likely send the markets up and the metals with it. Which way? Ultimately, USD down, markets up, but I am only concerned with my next work week, and it could go either way. The dollar is certainly due to bounce, but it also looks like it is about to fail in a big way, and maybe now is the time, driving a fat rally in the markets, and sending metals parabolic. I give this a 20% chance of happening this month, 50% chance of happening this year. I'll trade it when I see it.

How else to figure what the dollar is going to do, and thus the market? I almost never trade on Fibs, but no matter where I took a shot for the Euro/USD, things really lined up. Here is one shot, check it:

So if the Euro breaks up here, off we go to the races, especially in PM's. If SLV goes to $100 my wife says I can bring over a Russian 'exchange student' to polish my dubs daily. She'll be at the spa getting a rubdown from 'Sergie'.

Long version: ... we are at a bit of a decision point. Let's start with the S&P chart (SPY)

2 things, the obvious inverse head and shoulders pattern and the moving averages. I don't actively seek out h&s's, and the market could flick this pattern off like dandruff, but everybody must be talking about it (not been following twitter or doing much blog reading as of late). It makes for a bullish scenario. Also, the market managed to get above the 2 MA's, the 20 and 50, so this should act as support. We lose these averages on Monday and I am immediately cautious.

Since I am now spinning silver dubs on my Datsun B210, I take great interest in what the dollar is up to, as monetary policy drives the markets. I use the UUP for a quick read (check the vol on UDN friday, probably nothing, but), and then the EURO as my main benchmark. Why the Euro? In my mind it is the most 'like' comparison. Pound, country too small; Yen, govs are fighting to break it (trade on); Canadia, too solvent and Celine Dion; etc. Right now the charts are coiled up, with a move coming. More weakness will likely send the markets up and the metals with it. Which way? Ultimately, USD down, markets up, but I am only concerned with my next work week, and it could go either way. The dollar is certainly due to bounce, but it also looks like it is about to fail in a big way, and maybe now is the time, driving a fat rally in the markets, and sending metals parabolic. I give this a 20% chance of happening this month, 50% chance of happening this year. I'll trade it when I see it.

How else to figure what the dollar is going to do, and thus the market? I almost never trade on Fibs, but no matter where I took a shot for the Euro/USD, things really lined up. Here is one shot, check it:

So if the Euro breaks up here, off we go to the races, especially in PM's. If SLV goes to $100 my wife says I can bring over a Russian 'exchange student' to polish my dubs daily. She'll be at the spa getting a rubdown from 'Sergie'.

Wednesday, April 6, 2011

Trying for more dividend

I have been watching for some more high dividend entries. ARCC and AINV have gone well, and it is nice to get the monstrous check when the >%10 (annualized) divvy comes out.

It seems that many retail traders ignore the price on these, shop for them by yield, and think as long as they don't sell, they will just be collecting the dividend. I don't agree with that, and trade them on price action alone, hoping for equity gain as a cushion before I think of letting it go and let the checks come in.

I am slowly building this portfolio. These can really blow up in your face. Look at the long term charts. It does not mean much if you are collecting 10% but have lost 20% in equity. Once you get a couple and can put in a break even stop loss a few points below current price you can start adding more. It's a great way to park cash (once you are safely in with a cushion) and get some good return in a low return environment. Even if ultimately you get stopped out at break even, you made a good return while your cash was tied up.

The REIT's have been issuing more shares, so that is a potential land mine to look out for. You can limit buys to those with recent issues. Also pay attention to when the dividend dates are, as the stocks normally take a big gap down on these, and sometime slip even more. I like to buy a week or more after, and not close before, to see how things shake out.

With ARCC, it has been tough to look at the equity gain, and just sit back and take the check without taking profit, and exposing yourself to a round trip and getting stopped out. My solution for this is to buy double size and scale some out on the way up, so I can scratch the profit itch, and also reap the dividend.

I am no dividend stock wizard, so if there is some angle I am missing... let me know!

Here is a list to work off of, stocks yielding >10% and trading over 400k shares average per day:

get me div!

On watch are IVR (~17%!!!), ANH , BGY, among just a couple others. I was in PSEC but got bumped out and it has since run up (bummer, this one pays monthly!). I go over the charts of these every month or so to see how things are coming along. Can't remember the last time I saw a screaming technical setup. You just have to kind of find what you can get, really a reason to get in with a clear stop, as most of these charts are choppy ugly or slow steady movers one way or another. My ARCC and AINV entries were resistance breakouts within a range, and did retrace a bit, so I do give them more room and time than most things I trade.

It seems that many retail traders ignore the price on these, shop for them by yield, and think as long as they don't sell, they will just be collecting the dividend. I don't agree with that, and trade them on price action alone, hoping for equity gain as a cushion before I think of letting it go and let the checks come in.

I am slowly building this portfolio. These can really blow up in your face. Look at the long term charts. It does not mean much if you are collecting 10% but have lost 20% in equity. Once you get a couple and can put in a break even stop loss a few points below current price you can start adding more. It's a great way to park cash (once you are safely in with a cushion) and get some good return in a low return environment. Even if ultimately you get stopped out at break even, you made a good return while your cash was tied up.

The REIT's have been issuing more shares, so that is a potential land mine to look out for. You can limit buys to those with recent issues. Also pay attention to when the dividend dates are, as the stocks normally take a big gap down on these, and sometime slip even more. I like to buy a week or more after, and not close before, to see how things shake out.

With ARCC, it has been tough to look at the equity gain, and just sit back and take the check without taking profit, and exposing yourself to a round trip and getting stopped out. My solution for this is to buy double size and scale some out on the way up, so I can scratch the profit itch, and also reap the dividend.

I am no dividend stock wizard, so if there is some angle I am missing... let me know!

Here is a list to work off of, stocks yielding >10% and trading over 400k shares average per day:

get me div!

On watch are IVR (~17%!!!), ANH , BGY, among just a couple others. I was in PSEC but got bumped out and it has since run up (bummer, this one pays monthly!). I go over the charts of these every month or so to see how things are coming along. Can't remember the last time I saw a screaming technical setup. You just have to kind of find what you can get, really a reason to get in with a clear stop, as most of these charts are choppy ugly or slow steady movers one way or another. My ARCC and AINV entries were resistance breakouts within a range, and did retrace a bit, so I do give them more room and time than most things I trade.

Friday, April 1, 2011

Here

No really, here, but quiet on the blog front due to life happening. I have taken some swing (about to become long) positions, most notably YCS, which is short the Yen. I have tried this trade once before and got stopped out in short order, but this one has gone well, getting in on the string of almost-doji days at 15.40 . I have sold 1/3 of it already, but this is a long term play, and I think now is the time as governments seem to have agreed to do what they can to devalue the Yen and stimulate the economy there. This is a good fundamental play, and I will look for another technical entry to add more. Check the long term weekly FXY chart for the potential in this trade.

My only other current swing position is a smaug-like horde of SLV and DGP that I have been entering over the past two weeks (on top of my core SLV stake from last August). I think these will execute next week, or I will get stopped out if they break down through the 20 and close there. If they move up I plan to hold on to these a very long time, hoping a C-wave scenario plays out in PM's, a possible outcome that cycle style traders are hot on right now. Silver has been outperforming gold, but I dropped a little SLV for DGP in case they swap roles. Things tend to stay the same, so likely this move is not the right one, but I made the move anyway.

Wednesday, March 9, 2011

Best and worst trade from Wednesday, March 9th, 2011

Still kinda ailing, so sorry if this is a bit wonky:

My LNG trade was both my best and worst trade. It was good as I got in a on a real mover and made some serious gain, but left a lot on the table by not scaling out correctly in the secondary breakout. I got greedy, thinking it might keep running. In retrospect, the first sell might look like the most egregious, but most trades do not run like this one, and selling a third right away is a 'bread and butter' trade, make some quick gain in case it collapses back on itself, like many do. My scaling was fine for the first run, but again, the secondary scaling was terrible, as I thought I could maximize gains by letting it consolidate again and breakout again. It just faded the rest of the day. I should have kept tightening and got out in the break in at least the 8.50 area, and my last stop out should have been what was actually my next to last. Still, good one to be in.

Another plus is that this was a bounce play on a nasty sell off from the day before. I usually don't play these, and now I am not sure why and will look more. Half our trading room was in this play, and thanks to Cath for being the first to mention it on Tuesday, so it was on all our radars today.

My LNG trade was both my best and worst trade. It was good as I got in a on a real mover and made some serious gain, but left a lot on the table by not scaling out correctly in the secondary breakout. I got greedy, thinking it might keep running. In retrospect, the first sell might look like the most egregious, but most trades do not run like this one, and selling a third right away is a 'bread and butter' trade, make some quick gain in case it collapses back on itself, like many do. My scaling was fine for the first run, but again, the secondary scaling was terrible, as I thought I could maximize gains by letting it consolidate again and breakout again. It just faded the rest of the day. I should have kept tightening and got out in the break in at least the 8.50 area, and my last stop out should have been what was actually my next to last. Still, good one to be in.

Another plus is that this was a bounce play on a nasty sell off from the day before. I usually don't play these, and now I am not sure why and will look more. Half our trading room was in this play, and thanks to Cath for being the first to mention it on Tuesday, so it was on all our radars today.

Sunday, March 6, 2011

Back in the game

Well, not 100%, but much better and will be more involved in the game this week.

Here are some tickers with good risk/reward setups for aggressive traders. Some of these are a bit extended, so they could even be good shorts on a breakdown. The market is choppy right now, so I am trying to be much more selective, and keep stops much tighter. I want conviction in price movement and volume to be a believer.

ARGN TREX NXY PNM BGS PEET VGZ SONS (no particular order here).

My top pick from my last weeks Sunday night chart list, GPL, went gangbusters (alas, I was too out of it to be on it). PM's continue to outperform. This will continue until it does not :) My core SLV position continues to roll, still holding from last August.

Here are some tickers with good risk/reward setups for aggressive traders. Some of these are a bit extended, so they could even be good shorts on a breakdown. The market is choppy right now, so I am trying to be much more selective, and keep stops much tighter. I want conviction in price movement and volume to be a believer.

ARGN TREX NXY PNM BGS PEET VGZ SONS (no particular order here).

My top pick from my last weeks Sunday night chart list, GPL, went gangbusters (alas, I was too out of it to be on it). PM's continue to outperform. This will continue until it does not :) My core SLV position continues to roll, still holding from last August.

Sunday, February 20, 2011

Slow grind up continues

Visitors and being ill has slowed me down for a spell.

From my vantage point, those who have chosen the right stocks (not the hard part) and held on to them as swings or longs (the hard part for me) are the ones reaping the gains in this market. My daytrading has been a mixed bag, resulting in lots of work for little gain over the last 2 weeks. My long positions have been, of course, going great. Everyone is waiting for the inevitable correction. It may come on Monday, or it may come on a Monday in 2012. I will slowly attempt to add to longer term holdings, as I am beginning to suspect that this slow uptrend will last a long time, even if we a get a 3 day to 3 week or greater pullback. Is long term investing back? Could be, certainly has been working. No one seems to talk of this or expects this, making it a plausible contrarian view. The market is here to cause the most pain to the most people possible... this would really hurt people as scared money sits on the sidelines waiting to get in the and market just does not quit.

What else? TRADE THE BULL MARKETS!!! Precious metal have been in a long term bull market, and in the last couple months have offered ample opportunity to reinvest during a pullback and consolidation. Silver is leading gold and the miners. The miners are the underachieves, so why the bargain part of me says this will be the next part of the puzzle in the PM's bull run, the technical analyst part of me says that we need to see more obvious setups and some validation of strength before stepping in. Stick with the leaders and the good technical setups. Most mining charts are still messy, but showing promise.

Enough now, succumbing to body aches and coughing fits... yuk.

From my vantage point, those who have chosen the right stocks (not the hard part) and held on to them as swings or longs (the hard part for me) are the ones reaping the gains in this market. My daytrading has been a mixed bag, resulting in lots of work for little gain over the last 2 weeks. My long positions have been, of course, going great. Everyone is waiting for the inevitable correction. It may come on Monday, or it may come on a Monday in 2012. I will slowly attempt to add to longer term holdings, as I am beginning to suspect that this slow uptrend will last a long time, even if we a get a 3 day to 3 week or greater pullback. Is long term investing back? Could be, certainly has been working. No one seems to talk of this or expects this, making it a plausible contrarian view. The market is here to cause the most pain to the most people possible... this would really hurt people as scared money sits on the sidelines waiting to get in the and market just does not quit.

What else? TRADE THE BULL MARKETS!!! Precious metal have been in a long term bull market, and in the last couple months have offered ample opportunity to reinvest during a pullback and consolidation. Silver is leading gold and the miners. The miners are the underachieves, so why the bargain part of me says this will be the next part of the puzzle in the PM's bull run, the technical analyst part of me says that we need to see more obvious setups and some validation of strength before stepping in. Stick with the leaders and the good technical setups. Most mining charts are still messy, but showing promise.

Enough now, succumbing to body aches and coughing fits... yuk.

Monday, February 14, 2011

slow days

Slow up days in the market, and slow days for me as we have had company that has made my trading days erratic. No great gains, no great losses, just a quiet time for me after the productive first 5 weeks.

Monday, February 7, 2011

Friday, February 4, 2011

ARAY trade review

Good week with a nice ending. Though SIMG was the big dollar gainer for me today, I traded ARAY with a little less mechanical entry than SIMG. If you look at the SIMG intraday, I just bought the new high break at ~ 12 mins into the day and sold on the way up to highs. Simple, half the trading room was in it.

ARAY will be worth watching on Monday, as it has not completely broken out yet. It may just start forming a larger pattern that will take many more days, or it may just keep running.

Here is how I played it today.

ARAY will be worth watching on Monday, as it has not completely broken out yet. It may just start forming a larger pattern that will take many more days, or it may just keep running.

Here is how I played it today.

Thursday, February 3, 2011

Day of little gain

Lots of running to nowhere today, a positive day in spite of myself. After yesterday, that is fine, but I was just feeling too defensive today, not wanting to tarnish yesterday. If I had just let my remainder positions in ARMH and CRUS work, along with EEE I would have done as well or better, without all the thrashing about, but you have to be in to catch a good one, so that is the price you pay sometimes. I traded ESRX, CELL, TA, HNSN, and SFD. TA could have been a huge winner, but I went too small and my limit order did not get fully filled. Another vote against limit vs market buys. I made over a buck, but the size was so small, it had to get that far to matter. It did. The daily looks gorgeous, but was too hot for me to be effective. What is does prove is to stick with the high quality setups. What a flag, and what a result.

Wednesday, February 2, 2011

Benefits of trading within a group

I had a very good day, and part of my success was being in a room (virtual) where someone shouted out a ticker that was setting up, and I was in the right spot to take the trade. Thanks Cuda for the ARMH shoutout! Also, being around other people allows you to see other peoples trading styles; it expands your strategy base. The CGW room has traders that trade 10 shares and traders that trade 10,000 shares, and a very large range of experience. It can be a little overwhelming, but ultimately, by example, you see what works consistently over time. You see many more trades than you can actually make, so you get a boost of market experience. If you are interested in CGW, ask me about it. No, I get no commission or benefit by you joining.

I traded CRUS and ARMH, and sold off some EEE from last week, big plays for me; I took a very large position in ARMH. My only dud was PQ, and I had some boring trades with XING, of which I am swinging a touch, and NM. Good start to the month.

I traded CRUS and ARMH, and sold off some EEE from last week, big plays for me; I took a very large position in ARMH. My only dud was PQ, and I had some boring trades with XING, of which I am swinging a touch, and NM. Good start to the month.

Tuesday, February 1, 2011

Worst trade of the day, Tuesday, February 1st

Today was defined, unfortunately, by my first and worst trade, ADM. I also traded MTW, which I had to get in and out of twice (first for a loss), so that watered down my gain, coupled with my small size second entry and so I really did not hit it out of the park on the big run it took; but it helped a lot. SIMO I had to trade in and out twice also, and really only for a single both times. I had profitable little trades in KWK and VG, call them singles too, and a whiff in CRUS, and there is the whole day, a big hole with ADM and then scratching and clawing my way out for an ok day. I'll take it, but I might not like it.

Watch CRUS over the next day or two, nice setup.

Watch CRUS over the next day or two, nice setup.

Monday, January 31, 2011

Simple is best, CHK trade review.

Harold Jones used to tell me, "Luck favors the well prepared."

Energy has been in a strong bull run (check the 6 mos XLE chart). CHK offered a pretty decent flag at a time when they are fewer than they were a couple weeks ago. I simply bought the breakout of the daily. You could have set this buy stop a few days ago. The trade was never under water. A textbook breakout play, if only it were always this easy.

The daily chart with buy level:

The minute chart with the execution:

If only I had let more run, but it was early in the day and I wanted to book profits right away, make sure I got off to a good start for the week.

I also traded NPSP, getting a good early entry before the breakout; my other winner for the day. I traded XOM poorly for a decent gain, but was much to eager to take a profit, and I even knew it at the time; far and away my most painful trade of the day. I just did not want to give any away, so I left a good amount on the table. URG, BLTI, KEG and DEPO were trades taken with small gains or losses, nothing good.

Energy has been in a strong bull run (check the 6 mos XLE chart). CHK offered a pretty decent flag at a time when they are fewer than they were a couple weeks ago. I simply bought the breakout of the daily. You could have set this buy stop a few days ago. The trade was never under water. A textbook breakout play, if only it were always this easy.

The daily chart with buy level:

The minute chart with the execution:

If only I had let more run, but it was early in the day and I wanted to book profits right away, make sure I got off to a good start for the week.

I also traded NPSP, getting a good early entry before the breakout; my other winner for the day. I traded XOM poorly for a decent gain, but was much to eager to take a profit, and I even knew it at the time; far and away my most painful trade of the day. I just did not want to give any away, so I left a good amount on the table. URG, BLTI, KEG and DEPO were trades taken with small gains or losses, nothing good.

Friday, January 28, 2011

MSFT chart beauty

Since this a monthly chart, for this pattern to play out would likely take quite some time, but since you are interested in MSFT you are clearly not looking for a play that will make you money in short order. You could have bought MSFT for this same price about 10 years ago.

Still, if this breaks the downtrend line it could start moving significantly. Where to enter? Above 32 would be very conservative, entering the last few days aggressive (there was a breakout on the daily chart that failed), above 30 in the middle. After all, it has not broken the line yet, and may not for quite some time, but the duration of the tests are getting closer, looks pretty ripe to me.

If you are a pullback buyer, you could enter on touches of the 50 or 200dma's, draw fibs, of use your indicator of choice. I am a breakout player, mostly because I am impatient and want confirmation of a move rather that trying to anticipate and having consolidating stocks eat up my mental energy and my capital.

Once it breaks the line it can retest but spending anytime below it would be bearish. In clearer terms, if it gets above 32 I would not be happy to see it under 30 ever again.

Pretty chart and a simple plan.

Still, if this breaks the downtrend line it could start moving significantly. Where to enter? Above 32 would be very conservative, entering the last few days aggressive (there was a breakout on the daily chart that failed), above 30 in the middle. After all, it has not broken the line yet, and may not for quite some time, but the duration of the tests are getting closer, looks pretty ripe to me.

If you are a pullback buyer, you could enter on touches of the 50 or 200dma's, draw fibs, of use your indicator of choice. I am a breakout player, mostly because I am impatient and want confirmation of a move rather that trying to anticipate and having consolidating stocks eat up my mental energy and my capital.

Once it breaks the line it can retest but spending anytime below it would be bearish. In clearer terms, if it gets above 32 I would not be happy to see it under 30 ever again.

Pretty chart and a simple plan.

Thursday, January 27, 2011

Best and worst trades from Thursday, January 27th

Very active day for me, and a good day. Successful entries in EAT, ADTN, VRX, NVLS (swing leftover from yesterday), CCME (best trade), EEE. Got in and out of HE, CAT, ATPG (biggest money loser), CRUS (worst trade) and GLUU.

Yesterday after the Fed I felt that big money was waiting to hear the announcement to give the all clear signal for the coming months. Today felt decidedly stronger in the earnings gaps. There were some real winners I watched but missed, like SWK and CRUS (ouch). This idea may not be right, but it worked for me today, let's see how tomorrow goes.

The CCME trade was different as I only got filled about 1/3 of what I wanted. The trigger price minute candle moved .50 cents, and I use limit order (I know, I know, but I have my reasons, and it will take time to convince me otherwise, but this is one vote for market orders). So I let the position cook a all day, and the stock just kept climbing and was probably almost as profitable as if I had got a complete fill and scaled out (lame justification). It was just lucky to get this steady climber.

So, CCME and CRUS, best and worst, click away.

Yesterday after the Fed I felt that big money was waiting to hear the announcement to give the all clear signal for the coming months. Today felt decidedly stronger in the earnings gaps. There were some real winners I watched but missed, like SWK and CRUS (ouch). This idea may not be right, but it worked for me today, let's see how tomorrow goes.

The CCME trade was different as I only got filled about 1/3 of what I wanted. The trigger price minute candle moved .50 cents, and I use limit order (I know, I know, but I have my reasons, and it will take time to convince me otherwise, but this is one vote for market orders). So I let the position cook a all day, and the stock just kept climbing and was probably almost as profitable as if I had got a complete fill and scaled out (lame justification). It was just lucky to get this steady climber.

So, CCME and CRUS, best and worst, click away.

Tuesday, January 25, 2011

Best and worst trades from Tuesday, January 25th

Well, after a fantastic first week of January it has been slow going for me, which is fine, but boring. It is hard to be patient sometimes. Today was emblematic of the past week, with some great trades and some stinkers; a Jekyll and Hyde day.

My best trade was GLW, not because it made me the most money (I had a wonderful trade in PRGO today) but because it was an earnings gap buy on pullback, and pullback buying is not necessarily my strength. I have watched the pattern form so many times now that I was very confident in the trade, even with the retrace it took after my entry.

There are also notes in the worst trade of the day, WBS, click on the charts to make them bigger/readable.

My best trade was GLW, not because it made me the most money (I had a wonderful trade in PRGO today) but because it was an earnings gap buy on pullback, and pullback buying is not necessarily my strength. I have watched the pattern form so many times now that I was very confident in the trade, even with the retrace it took after my entry.

There are also notes in the worst trade of the day, WBS, click on the charts to make them bigger/readable.

Saturday, January 22, 2011

SPY follow up

As a follow up to this post on the SPY from a few days ago, which regards the health of the market over the near term (many use the SPY as a proxy for the health of the overall market), notice 2 days ago the market opened right on the resistance level, as evidenced by the body of the candle resting on support, then traded down for a perfect bounce off the 20 day moving average (green line). Yesterday the market traded up, the first lines of support held in textbook fashion.

(click for bigger image)

So if we are to continue downward, it will likely be an erratic path as there are many levels for the indexes (pick you poison, Q's, SPY, DJIA, RUT, even sector plays) to violate and bounce from... that is if we don't quickly resume moving to new highs, or just bang around in a consolidation zone for some time. For now, stay with what is working.

(click for bigger image)

So if we are to continue downward, it will likely be an erratic path as there are many levels for the indexes (pick you poison, Q's, SPY, DJIA, RUT, even sector plays) to violate and bounce from... that is if we don't quickly resume moving to new highs, or just bang around in a consolidation zone for some time. For now, stay with what is working.

Wednesday, January 19, 2011

Short term SPY analysis

Had an email request for my view on SPY short term:

The only negative for the SPY is on the minute charts we have broken a valid trend line that was active since January 10th, and lost some short term moving averages, most notably the 5dma, but that is not uncommon. Volume was not unusual today. We bounced off of previous resistance ~127.90 which is now support.