Harold Jones used to tell me, "Luck favors the well prepared."

Energy has been in a strong bull run (check the 6 mos XLE chart). CHK offered a pretty decent flag at a time when they are fewer than they were a couple weeks ago. I simply bought the breakout of the daily. You could have set this buy stop a few days ago. The trade was never under water. A textbook breakout play, if only it were always this easy.

The daily chart with buy level:

The minute chart with the execution:

If only I had let more run, but it was early in the day and I wanted to book profits right away, make sure I got off to a good start for the week.

I also traded NPSP, getting a good early entry before the breakout; my other winner for the day. I traded XOM poorly for a decent gain, but was much to eager to take a profit, and I even knew it at the time; far and away my most painful trade of the day. I just did not want to give any away, so I left a good amount on the table. URG, BLTI, KEG and DEPO were trades taken with small gains or losses, nothing good.

Monday, January 31, 2011

Friday, January 28, 2011

MSFT chart beauty

Since this a monthly chart, for this pattern to play out would likely take quite some time, but since you are interested in MSFT you are clearly not looking for a play that will make you money in short order. You could have bought MSFT for this same price about 10 years ago.

Still, if this breaks the downtrend line it could start moving significantly. Where to enter? Above 32 would be very conservative, entering the last few days aggressive (there was a breakout on the daily chart that failed), above 30 in the middle. After all, it has not broken the line yet, and may not for quite some time, but the duration of the tests are getting closer, looks pretty ripe to me.

If you are a pullback buyer, you could enter on touches of the 50 or 200dma's, draw fibs, of use your indicator of choice. I am a breakout player, mostly because I am impatient and want confirmation of a move rather that trying to anticipate and having consolidating stocks eat up my mental energy and my capital.

Once it breaks the line it can retest but spending anytime below it would be bearish. In clearer terms, if it gets above 32 I would not be happy to see it under 30 ever again.

Pretty chart and a simple plan.

Still, if this breaks the downtrend line it could start moving significantly. Where to enter? Above 32 would be very conservative, entering the last few days aggressive (there was a breakout on the daily chart that failed), above 30 in the middle. After all, it has not broken the line yet, and may not for quite some time, but the duration of the tests are getting closer, looks pretty ripe to me.

If you are a pullback buyer, you could enter on touches of the 50 or 200dma's, draw fibs, of use your indicator of choice. I am a breakout player, mostly because I am impatient and want confirmation of a move rather that trying to anticipate and having consolidating stocks eat up my mental energy and my capital.

Once it breaks the line it can retest but spending anytime below it would be bearish. In clearer terms, if it gets above 32 I would not be happy to see it under 30 ever again.

Pretty chart and a simple plan.

Thursday, January 27, 2011

Best and worst trades from Thursday, January 27th

Very active day for me, and a good day. Successful entries in EAT, ADTN, VRX, NVLS (swing leftover from yesterday), CCME (best trade), EEE. Got in and out of HE, CAT, ATPG (biggest money loser), CRUS (worst trade) and GLUU.

Yesterday after the Fed I felt that big money was waiting to hear the announcement to give the all clear signal for the coming months. Today felt decidedly stronger in the earnings gaps. There were some real winners I watched but missed, like SWK and CRUS (ouch). This idea may not be right, but it worked for me today, let's see how tomorrow goes.

The CCME trade was different as I only got filled about 1/3 of what I wanted. The trigger price minute candle moved .50 cents, and I use limit order (I know, I know, but I have my reasons, and it will take time to convince me otherwise, but this is one vote for market orders). So I let the position cook a all day, and the stock just kept climbing and was probably almost as profitable as if I had got a complete fill and scaled out (lame justification). It was just lucky to get this steady climber.

So, CCME and CRUS, best and worst, click away.

Yesterday after the Fed I felt that big money was waiting to hear the announcement to give the all clear signal for the coming months. Today felt decidedly stronger in the earnings gaps. There were some real winners I watched but missed, like SWK and CRUS (ouch). This idea may not be right, but it worked for me today, let's see how tomorrow goes.

The CCME trade was different as I only got filled about 1/3 of what I wanted. The trigger price minute candle moved .50 cents, and I use limit order (I know, I know, but I have my reasons, and it will take time to convince me otherwise, but this is one vote for market orders). So I let the position cook a all day, and the stock just kept climbing and was probably almost as profitable as if I had got a complete fill and scaled out (lame justification). It was just lucky to get this steady climber.

So, CCME and CRUS, best and worst, click away.

Tuesday, January 25, 2011

Best and worst trades from Tuesday, January 25th

Well, after a fantastic first week of January it has been slow going for me, which is fine, but boring. It is hard to be patient sometimes. Today was emblematic of the past week, with some great trades and some stinkers; a Jekyll and Hyde day.

My best trade was GLW, not because it made me the most money (I had a wonderful trade in PRGO today) but because it was an earnings gap buy on pullback, and pullback buying is not necessarily my strength. I have watched the pattern form so many times now that I was very confident in the trade, even with the retrace it took after my entry.

There are also notes in the worst trade of the day, WBS, click on the charts to make them bigger/readable.

My best trade was GLW, not because it made me the most money (I had a wonderful trade in PRGO today) but because it was an earnings gap buy on pullback, and pullback buying is not necessarily my strength. I have watched the pattern form so many times now that I was very confident in the trade, even with the retrace it took after my entry.

There are also notes in the worst trade of the day, WBS, click on the charts to make them bigger/readable.

Saturday, January 22, 2011

SPY follow up

As a follow up to this post on the SPY from a few days ago, which regards the health of the market over the near term (many use the SPY as a proxy for the health of the overall market), notice 2 days ago the market opened right on the resistance level, as evidenced by the body of the candle resting on support, then traded down for a perfect bounce off the 20 day moving average (green line). Yesterday the market traded up, the first lines of support held in textbook fashion.

(click for bigger image)

So if we are to continue downward, it will likely be an erratic path as there are many levels for the indexes (pick you poison, Q's, SPY, DJIA, RUT, even sector plays) to violate and bounce from... that is if we don't quickly resume moving to new highs, or just bang around in a consolidation zone for some time. For now, stay with what is working.

(click for bigger image)

So if we are to continue downward, it will likely be an erratic path as there are many levels for the indexes (pick you poison, Q's, SPY, DJIA, RUT, even sector plays) to violate and bounce from... that is if we don't quickly resume moving to new highs, or just bang around in a consolidation zone for some time. For now, stay with what is working.

Wednesday, January 19, 2011

Short term SPY analysis

Had an email request for my view on SPY short term:

The only negative for the SPY is on the minute charts we have broken a valid trend line that was active since January 10th, and lost some short term moving averages, most notably the 5dma, but that is not uncommon. Volume was not unusual today. We bounced off of previous resistance ~127.90 which is now support.

We are still fine on the daily chart. Should we continue lower, there are plenty of downside targets available. If we are to start any sort of downtrend we need to either continue tomorrow and thereafter with increasing volume, likely accompanied by some sort of 'event', or the market will need to put in a series of lower highs and lower lows which will take many days/weeks to establish.

Right now this looks like nothing more than a simple pullback, and not any game changing event. In the short term we may have more downside, but likely we will find support and the market will enter a neutral range and bang about in that for a spell, which should allow swings and longer holds to continue working if you are positioned correctly. More downside is also an opportunity to look for relative strength in industries and individual names so when the market turns back up, you have a list of target entries and a better chance of being properly positioned for the next leg up.

If we establish a series of lower highs and lower lows on the daily over the next couple weeks, or put in a quick and violent downside continuation for the next few days then it will be time to focus on the short side for anything more than a quick scalp or day trade opportunity for the nimble. Very active traders, may of course already be trying to position for more downside, but those would smartly be test positions at best.

The only negative for the SPY is on the minute charts we have broken a valid trend line that was active since January 10th, and lost some short term moving averages, most notably the 5dma, but that is not uncommon. Volume was not unusual today. We bounced off of previous resistance ~127.90 which is now support.

We are still fine on the daily chart. Should we continue lower, there are plenty of downside targets available. If we are to start any sort of downtrend we need to either continue tomorrow and thereafter with increasing volume, likely accompanied by some sort of 'event', or the market will need to put in a series of lower highs and lower lows which will take many days/weeks to establish.

Right now this looks like nothing more than a simple pullback, and not any game changing event. In the short term we may have more downside, but likely we will find support and the market will enter a neutral range and bang about in that for a spell, which should allow swings and longer holds to continue working if you are positioned correctly. More downside is also an opportunity to look for relative strength in industries and individual names so when the market turns back up, you have a list of target entries and a better chance of being properly positioned for the next leg up.

If we establish a series of lower highs and lower lows on the daily over the next couple weeks, or put in a quick and violent downside continuation for the next few days then it will be time to focus on the short side for anything more than a quick scalp or day trade opportunity for the nimble. Very active traders, may of course already be trying to position for more downside, but those would smartly be test positions at best.

Tuesday, January 18, 2011

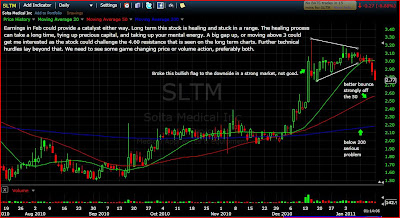

SLTM and ZLCS

Had a request to look at these two bottom fishing plays, but look, don't let my negative outlook sway your conviction, buy them up, because maybe they are both going to 20+, but currently the price action says 'no':

(click on the images to get them up to size)

(click on the images to get them up to size)

Friday, January 14, 2011

Best and worst trades from Friday, January 14

Sold ICLR and KNDI today, did not gain for holding them overnight, but they were still well in the money from the entries but would have fared better selling them yesterday. Still holding PWAV, its fine, I have a 5$ fantasy target on this one, but the charts show it should work if the market keeps grinding sideways or up. Yes, I was right in that I should have held TTMI, so the lesson is turn in the tired horse, ICLR, for the fresh one. KNDI was fine, just didn't work.

SPR was the winner today, though it was a grind it out affair, and not a beautiful flyer like for those that got in NANO today. KLAC was the loser, for me anyway, not everyone. I also traded BDSI, CPHD, and SGI (thx CGW crew for this one), which were all good, and CPIX for -.02, my other dud.

As always, click on them to make them bigger:

SPR was the winner today, though it was a grind it out affair, and not a beautiful flyer like for those that got in NANO today. KLAC was the loser, for me anyway, not everyone. I also traded BDSI, CPHD, and SGI (thx CGW crew for this one), which were all good, and CPIX for -.02, my other dud.

As always, click on them to make them bigger:

Thursday, January 13, 2011

Best and worst trades, Thursday, January 13

Sold some of that PWAV swing today, still holding ICLR, though feeling iffy on it. Bought KNDI today and holding half of it overnight too. Probably should have held some TTMI, which I show below, along with EXFO, the dog of the day, but not that bad of a dog.

Carnac predictions for 2011

I really wanted to do this in December, but my trading style has changed so much that making macro predictions is not worth my time. But it is fun, so I just came up with some categories, took some guesses, and made vague statements like 'outperform':

Gold/Precious metals: still upside

Food and Water: Biggest upside into 2012 and beyond, outperforms all commodities. Invest in water, hoard physical.

Semi's may lurch back, but gain for the year

Market as a whole: May have a significant pullback, but ends up for year. My guess is N shaped, up, down, up. Second guess is V shape, down soon, then up. Cycle theory says this is most probable, but I am going with N.

UNG and TBT: Still too early. Maybe TBT in last quarter. Oil up, but not enough to help UNG and solar.

Solar: still, and always, sucks (and I am a fan), ...until 2nd half, then start moving

Homies: still suck, all year

Telecom: Outperforms in a boring way

Retail: Outperforms in a no one can believe it way

Energy: Good first half, bad second.

Finnies:Gets everyone lathered, then breaks hearts.

Super Bowl: Ravens or Falcons... Falcons it is.

British Open: Els

Wimpleton: Murray, feel good story.

Tour: Schleck

Bolt goes 9.54

ASP: Fanning

Coin flip: Tails

Gold/Precious metals: still upside

Food and Water: Biggest upside into 2012 and beyond, outperforms all commodities. Invest in water, hoard physical.

Semi's may lurch back, but gain for the year

Market as a whole: May have a significant pullback, but ends up for year. My guess is N shaped, up, down, up. Second guess is V shape, down soon, then up. Cycle theory says this is most probable, but I am going with N.

UNG and TBT: Still too early. Maybe TBT in last quarter. Oil up, but not enough to help UNG and solar.

Solar: still, and always, sucks (and I am a fan), ...until 2nd half, then start moving

Homies: still suck, all year

Telecom: Outperforms in a boring way

Retail: Outperforms in a no one can believe it way

Energy: Good first half, bad second.

Finnies:Gets everyone lathered, then breaks hearts.

Super Bowl: Ravens or Falcons... Falcons it is.

British Open: Els

Wimpleton: Murray, feel good story.

Tour: Schleck

Bolt goes 9.54

ASP: Fanning

Coin flip: Tails

Tuesday, January 11, 2011

My 2010 predictions and how they fared

LOL, I just pulled these up from last year. I love my GE dismantled prediction... didn't happen. JJG came on in the second half of the year, and the TBT and UNG prediction was spot on. I still think a food squeeze might be coming, as it is the possible bubble that no one talks about, and it has the two elements that can really drive a panic, absolute necessity and fear. I hope I am wrong, but will be watching.

Rick__H RickH

my upside bias: $twentyten large caps/dow stocks break to all time highs as econmy stays flat, many small caps left for dead. quality leads

»

Rick__H RickH

my downside bias: $twentyten still too early for $TBT and $UNG. Food will be the next bubble $JJG. $GE dismantled.

Best and worst trades from Tuesday, January 11th

I made a number of trades today. ASTI ASYS NCT ICLR(swing) RPRX ARIA ATSG CIE (swing) EEE.

Best trade: I use an emotional barometer on trades. I needed to decide when to sell the remaining portion of my EEE swing from a couple days ago. I decided that when I had a 90% profit, that it would hurt more to watch it go away than watch it keep going. So I sold it off in two parts with an average sell of 2.14 on my 1.09 entry. Course it went past 2.50 today, but I am fine with that, that is a whopper % gain, and I might have to wait quite a while for that to happen again.

Worst trade, where I gave back much of my EEE gain from today:

Here's what I am watching tomorrow along with the morning earnings/gap plays: VRX CPNO MNKD ATSG TRGL PWAV IBCP TFSL

Best trade: I use an emotional barometer on trades. I needed to decide when to sell the remaining portion of my EEE swing from a couple days ago. I decided that when I had a 90% profit, that it would hurt more to watch it go away than watch it keep going. So I sold it off in two parts with an average sell of 2.14 on my 1.09 entry. Course it went past 2.50 today, but I am fine with that, that is a whopper % gain, and I might have to wait quite a while for that to happen again.

Worst trade, where I gave back much of my EEE gain from today:

Here's what I am watching tomorrow along with the morning earnings/gap plays: VRX CPNO MNKD ATSG TRGL PWAV IBCP TFSL

Friday, January 7, 2011

Friday, neat day

I had hoped the slew of earnings would provide some good trading opps in the morning, and it did, but the 2 that worked well, RBN and one other, can't remember right now, took off after the 1st minute bar, and I was just not at the right spot in the 10 seconds or so it took to take them. So I sat around all morning watching people make trades while nothing caught my eye for my style. Come the lunch lull and Jay in the CGW chatroom called out HE, and we noticed this was the second electrical utility to go off in the last 2 days... and I always thought utilities were for your grandpa, stodgy, slow, with a mediocre dividend. A quick scan of the tickers in the industry found 3 decent setups and I set buy stops for all 3. Two triggered, EEE and CEG. John Lee had been drilling us the last two days on only taking the best setups, and adding a dash of his old post about sequential breakouts, and viola, patience got me these two nice trades to close out the first week of 2011, my only trades of the day. 1/4 of my realized gain in EEE was +20%, not a bad gain for 2hrs.

Here is the EEE trade.

The setup

The execution

Here is the EEE trade.

The setup

The execution

Thursday, January 6, 2011

Thursday trading

TOS/Ameritrade broke a trade for me today. I had a GTC buy stop set for ICLR to trigger at ~22.25 (can't remember exact right now), but right at the open the trade triggered and filled at 22.12, but on a couple different platforms the price never exceeded 21.90 for a while after the open. I am fine getting triggered and having the stock back off, but not even showing a price close to my fill is not right. Anyway, TOS thought it did not pass the smell test either and broke the trade. If its fishy, call. And it always good to be reminded that on a thin stock like ICLR that the opening nano-second can see wild bid/ask swings before it all fills in, and stops can get triggered either way. That is why I don't always like to have hard stops set for the open or close.

I traded CKSW (played the opening break at 8.84, decent, but round tripped 1/3 of it... had high hopes), JOE (got at 22.51, sold all by eod, thx Jay!), DVR (lost a couple pennies), LINE (did fine on first 1/3, made a couple pennies on rest, meh), BZH (made a penny). Day of singles and walks, not bad, pays the bills. The SHZ and MVIS swings were sold yesterday, nothing thrilling.

I traded CKSW (played the opening break at 8.84, decent, but round tripped 1/3 of it... had high hopes), JOE (got at 22.51, sold all by eod, thx Jay!), DVR (lost a couple pennies), LINE (did fine on first 1/3, made a couple pennies on rest, meh), BZH (made a penny). Day of singles and walks, not bad, pays the bills. The SHZ and MVIS swings were sold yesterday, nothing thrilling.

Tuesday, January 4, 2011

Best and worst trade Tuesday January 4th.

I think I will also start adding all the tickers I traded, along with the mark-ups of the best and and worst. So today, in addition to the two below, I also bought MVIS at 2.10 which I am holding overnight. So only 3 buys today. Also wanted ICLR, but it did not trigger. It put in some higher vol today, including a 100k block after the close. ICLR is not one to buy aggressively in anticipation as it is a real churner, and thin. My planned position is pretty small. I would not be shocked to see it gap past me, so I may never get it.

Subscribe to:

Posts (Atom)

Early winner/loser in 5g, Ericsson ERIC, Nokia NOK

I like to start collecting stock tickers for after the new year, stocks that have been beaten down and window dressed more than they deserve...

-

Nice to have earnings season here, should at least give some individual names some solid direction, and maybe hold up the market. I had a ni...

-

No really, here, but quiet on the blog front due to life happening. I have taken some swing (about to become long) positions, most notably ...

-

My trading has been flat and uninspiring the last week. I have chopped about, and for every good trade there has been a bad one. Today is a ...