Nice to have earnings season here, should at least give some individual names some solid direction, and maybe hold up the market. I had a nice one in RIG which was called out in real time in the BOWS chat room, but I also got a guidance/earnings gap play first thing in the morning, and I hope there will be many more to come, you just never know how things will start shaking out. Here's the good...

... and the bad:

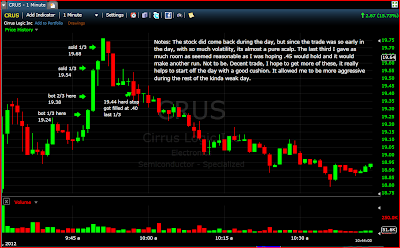

These gappers don't need much market support, even if the market is fading and not plunging, they have all the strength they need on their own if the volume is there.

Subscribe to:

Post Comments (Atom)

Early winner/loser in 5g, Ericsson ERIC, Nokia NOK

I like to start collecting stock tickers for after the new year, stocks that have been beaten down and window dressed more than they deserve...

-

Nice to have earnings season here, should at least give some individual names some solid direction, and maybe hold up the market. I had a ni...

-

My trading has been flat and uninspiring the last week. I have chopped about, and for every good trade there has been a bad one. Today is a ...

-

Had an email request for my view on SPY short term: The only negative for the SPY is on the minute charts we have broken a valid trend lin...

Hi, enjoying your reviews. Question on BOW, do they trade only penny stocks? On their recent trade list there's nothing over $3.

ReplyDeleteThanks!

Hey KIS, thanks.

ReplyDeleteFor BOWS I am relatively new there. No, not only penny stocks. There has been a strong focus on small caps, though, as it is part of a trading strategy Kunal focuses on at the end of the year into the new year. It has been good for me to learn the skills necessary to trade these penny (and sometimes low vol) names. There are plenty of trades in all kinds of stocks, there is a mix of all kinds of traders there, with emphasis on daytrades and swings. There are a lot of good traders there, and it is a great environment for active traders, very positive vibe. Kunal really likes to focus on % gains, and you can get some huge % plays in those small names. I think if you go back and check his tweets you will get a good idea, but he is not the only trader in the room and everyone gravitates toward their own style. I think there is a two week free sign up, so you can always check it out. Let me know if you try it out, there is a ton of education stuff on all his trades setups, I can point you in the right direction. Cheers, Rick

Those look like tough entries on at least those first two "misses" in ELX -- I think you may be too hard on yourself. They look OK in perfect hindsight, but I'm not sure exactly what you feel you missed that made them real obvious entry points, esp. on that bottom bounce. Maybe 4 minutes later was a more "obvious" entry to me in hindsight.

ReplyDeleteNot looking at anything other than what you show here, though, so maybe there were other s/r levels as keys.

Enjoying your posts, as always.

Thx 888. Yes, hindsight always easier. That was a valid downtrend line with 3+ solid touches, and with higher than avg volume. On the TOS platform you can set a line that extends as the price plays out, the moment it breaks over it, you can jump in. Plus it was a pullback to some pretty clear support (as you mentioned). I like to mark those up before the open. I like these entries as you can play it with pretty small size, and if it breaks hod you get a pretty large risk/reward out of it. The second is a pretty clear flag with good risk reward if you want to play it tight, at that point, with all the vol, there is a pretty good chance it is going to shoot for the highs and traders are going to pile in. All that said, can pull up charts with the same setups that are total failures, no sure setups. Trade em well, Rick

ReplyDelete